Highlights

- Enterprise vs. SMB sales is about fundamentally different buyer expectations, decision cycles, and success metrics.

- Enterprises demand trust, scalability, and long-term ROI, while SMBs prioritize speed, affordability, and immediate value.

- Enterprise deals can take 6–18 months with multi-stakeholder approvals, while SMB sales often close in 30–90 days with faster, product-led decisions.

- Winning across both markets requires a dual strategy: consultative, account-based engagement for enterprises and frictionless, digital-first selling for SMBs.

Introduction

B2B selling today looks very different from what it did even a few years ago. The core of the B2B sales process, knowing your buyer, building trust, and guiding them to a decision that hasn’t changed. But the way you approach a global enterprise compared to a small or mid-sized business (SMB) couldn’t be more different.

The difference between SMB and enterprise sales goes far beyond deal size. It shapes the entire B2B sales cycle, influences how buyers make decisions, and redefines what value means to them. That’s why sales teams can’t rely on a one-size-fits-all approach. Instead, they need a B2B sales strategy designed to reflect the unique expectations and buying behaviors of each segment.

In this article, we’ll take a closer look at the SMB vs. enterprise sales process, explore the challenges and opportunities in both, and share practical strategies that can help sales leaders drive growth in today’s competitive market.

Who are the Buyers? Who are your Reps? Who Needs to Be Involved?

SMB buyers are typically small leadership teams or owners who make rapid decisions. The SMB buying group tends to be compact, often 1–4 people and decisions are urgency-driven. That shapes a short, product-led SMB sales process and a high-volume outreach model.

Enterprise buyers are multi-stakeholder buying groups, including procurement, IT, business unit owners, legal, security, and finance. The average buying group size reported in 2024–25 ranges from roughly 6 to 13 participants depending on the study and industry. That means multithreaded relationships and a long enterprise sales cycle.

Who is on your side? For SMB, you want sellers who close quickly (SDRs + quick-play closers, digital trials, and self-serve flows). For enterprise you want senior, consultative account execs, solution architects, customer success involvement, and product/engineering access during negotiations.

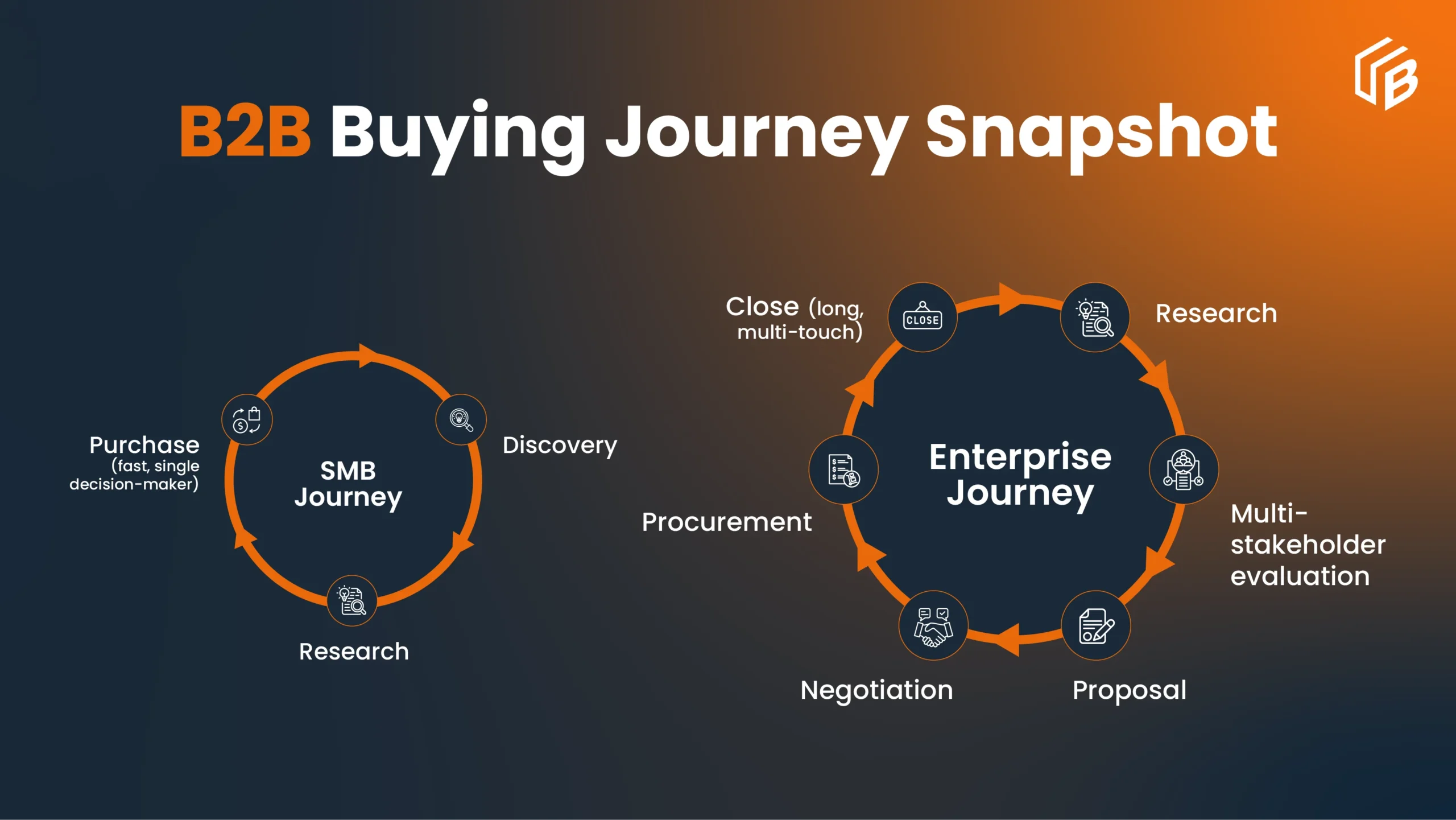

How the Sales Cycle Unfolds for Enterprise vs. SMB

The B2B sales cycle varies dramatically depending on who you’re selling to. Let’s look at how the enterprise sales vs. SMB sales dynamics play out in real-world terms, with hard data to back it up.

Enterprise Sales Cycle:

In large organizations, selling is inherently consultative and relationship-driven. Buyers often expect face-to-face interactions, deep discovery sessions, and formal presentations. In fact, 38% of B2B buyers prefer in-person meetings as their initial contact, especially when evaluating high-stakes solutions.

However, the landscape is shifting. According to Gartner, a staggering 75% of B2B buyers now prefer a completely rep-free sales experience, especially in the early stages of the buyer’s journey. This signals a growing need for enterprise teams to blend in-person trust-building with digital-first convenience.

SMB Sales Process:

On the SMB side, the B2B selling process is overwhelmingly digital. More than 70% of SMB B2B decision-makers prefer digital self-service or remote interactions over traditional face-to-face meetings. Gartner projects that by 2025, 80% of B2B sales interactions will occur through digital channels, dispelling the myth that big deals always need a personal touch.

Key Takeaway:

Enterprises still need high-touch engagement for complex, high-value dealings, consultative selling remains essential. But that approach must now be integrated with digital self-service options. Meanwhile, SMBs are embracing speed and simplicity: self-serve models, digital demos, and automated workflows are where they thrive.

When Do Deals Close in Enterprise vs. SMB Sales?

One of the most defining differences in enterprise sales vs. SMB sales is how long it takes to close a deal. Timelines are not just numbers on a forecast, they reflect the complexity of decision-making, the size of the investment, and the level of risk buyers are willing to take.

Enterprise sales cycle:

According to CSO Insights, the average enterprise deal can take 6 to 18 months to finalize. This drawn-out B2B sales cycle isn’t accidental. Large organizations often involve multiple layers of approvals, legal and compliance checks, and deep technical assessments. With so many stakeholders at the table, sometimes across different regions, every stage requires careful alignment.

For example, a Fortune 500 company investing in an enterprise-level SaaS platform may need IT, finance, procurement, and operations to all agree before signing off, adding months to the timeline.

Charlene Currie, MBA, PMP and President of MOR Consulting Group™, notes:

“Most enterprise sales teams track wins but ignore the deal slippage rate. They miss what quietly rolls forward quarter after quarter and why. Without that insight, you can’t forecast accurately, refine your message so it resonates, or connect with customers in a way that converts… If you can’t diagnose the friction, you’ll keep bleeding revenue while calling it a pipeline.”

SMB sales process:

On the other hand, the SMB sales cycle is far more agile. Deals usually close within 30 to 90 days, sometimes even faster for low-cost, self-service solutions. SMB buyers tend to value speed and immediate results. They don’t have the luxury of extended evaluations, cash flow and quick wins often dictate their decisions.

A growing mid-sized firm, for instance, might adopt a marketing automation tool after a short demo and a two-week trial because the ROI is clear and the risk is relatively low.

Key takeaway:

The contrast in timelines underscores the need for different strategies. Enterprise sales demand patience, long-term nurturing, and detailed forecasting models, while SMB sales reward agility, fast onboarding, and streamlined decision-making. Sales leaders who can balance both approaches position themselves to win across markets.

Why Enterprise vs SMB Sales Strategies Look Different

The difference between SMB and enterprise sales goes beyond company size. Buyer motivations and priorities directly shape the b2b sales process and how sales teams position their solutions.

Enterprise Buyers:

- Operate with higher stakes and larger investments.

- Prioritize scalability, risk reduction, vendor reputation, and measurable ROI.

- Seek long-term partners rather than just product vendors.

- Evaluate factors such as financial stability, industry expertise, and integration capabilities.

- In the enterprise sales cycle, decisions are influenced by multiple stakeholders, making the enterprise B2B sales process more trust- and relationship-driven.

As Todd Hagopian, Executive Director at Stagnation Intelligence Agency, puts it:

“The hidden metric destroying enterprise sales? Internal Friction Cost—the hours your team burns navigating your own company’s complexity to serve the customer. When selling internally takes longer than selling externally, you’re already losing.”

SMB Buyers:

- Focus on affordability, quick setup, and immediate value.

- Expect solutions that can deliver fast ROI with minimal customization.

- The SMB sales process is shorter, often driven by the need to solve pressing challenges.

- Prioritize ease of adoption and transparent pricing over complex features.

- The most effective SMB B2B sales strategy centers on speed, automation, and reducing friction.

Key Takeaway:

- The enterprise vs SMB sales strategy diverges because of buyer expectations:

- Enterprises value predictability, strategic partnership, and long-term ROI.

- SMBs value agility, cost-effectiveness, and tools that drive immediate results.

How to Win in Both Markets

Mastering the SMB vs enterprise sales process requires adapting the b2b selling process to the realities of each buyer type. Here’s how:

For Enterprises:

- Map all stakeholders early to understand the decision-making hierarchy.

- Use account-based selling strategies to build tailored engagement.

- Demonstrate ROI with detailed case studies, pilot programs, and business cases.

- Prepare for extended enterprise sales cycles with consistent nurturing and multi-channel touchpoints.

For SMBs:

- Keep pricing transparent, simple, and easy to understand.

- Ensure onboarding and support are frictionless.

- Build your SMB B2B sales strategy around speed, automation, and user-friendly digital tools.

- Streamline the SMB vs enterprise sales process by reducing barriers to purchase, such as lengthy contracts or complex demos.

FAQs

1. What is a B2B SMB?

A B2B SMB refers to a small or mid-sized business that sells products or services to other businesses. Typically, SMBs have fewer than 1,000 employees and shorter decision-making cycles.

2. What Strategies Work Best In Enterprise B2B Sales?

Enterprise sales strategies should focus on account-based selling, stakeholder alignment, ROI-focused presentations, and long-term value demonstration.

3. Why Do Enterprises Require a Different B2B Sales Strategy Than SMBs?

Because enterprises deal with higher risk, complex integrations, and multiple stakeholders, they need a tailored enterprise B2B sales process that emphasizes trust, scale, and compliance.

4. How Long is the Sales Cycle For SMB vs. Enterprise Sales?

The average SMB deal closes in 30–90 days, while the average enterprise sales cycle can take 6–18 months.

Conclusion

The reality is clear: enterprise sales vs. SMB sales are two distinct approaches within the broader world of B2B selling. Enterprises require patience, multiple stakeholder engagement, and a consultative approach, while SMBs reward agility, simplicity, and immediate ROI.

Our blog

Latest blog posts

Tool and strategies modern teams need to help their companies grow.

Marketers often confuse drips vs nurtures, but each plays a distinct role in B2B emai...

AI in B2B marketing, future of B2B marketing, ai in marketing, ai in marketing automa...

In this article, we are exploring how modern B2B purchasing is shaped by cross-functi...